The South Sea Bubble is a prominent event in the history of England. It started with the conception of the South Sea Company in 1711 by the associates of the Tory government in England. Gradually, the company started a process of financial investment that grew more and more complex as political, legal and cultural factors start to affect the ventures of the company.

Table of Contents

The South Sea Company

The South Sea Company was formed to trade with Spanish America, mostly in slaves. Due to their association with the government, the company was given the sole rights of trading in Spanish America through the Pacific Ocean. However, when the company was formed, England was still at war with Spain and there were several trade restrictions in Spanish America.

However, due to the promising returns, many people invested their money in the company by buying their shares. The war between Spain and England ended with the Treaty of Utrecht in 1713 and that became a major turning point for the future of The South Seas Company.

The major reason for this was that the monopoly of trade to Spanish America was given to Spain in the treaty and that meant that The South Sea Company cannot participate in business with people of that areas. It was in 1717 when The South Sea Company managed to make their first trade with Spanish America.

By the next year, the relationship between the countries had further declined and trade came to a halt.

The building up of South Sea Bubble

As a result of the war with Spain, England had a large debt. The founders of the South Sea Company managed to bribe and convince the members of the Parliament to pass a bill in 1720. The bill was an attempt to clear the national debt on the part of the government.

According to it, the people to whom the Government of England owed finances were given stocks of The South Sea Company. As a result of the bill, the company had assumed around £9,000,000, which was about three-fifths of the national debt of the country.

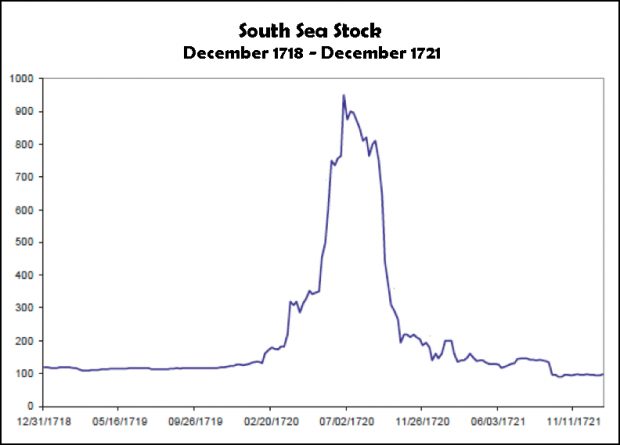

This event created a buzz in the market about the company and the value of its stock started to increase remarkably. Within a very short period of time, the value of the stock of the company increased about 10 times, reaching almost £1,000. To benefit from the market, a number of other smaller companies were started that were taking up unrealistic ventures. Strangely, many people in England invested in such companies.

By the end of this façade, the South Seas Company had procured almost £30 million of the national debt of the government of England. Many rich and poor people invested in the company and also in similar smaller enterprises that had mushroomed in effect.

The bursting of the South Sea Bubble

The South Sea Company bribed the government officials to pass a bill that stated that all the companies that are floating their stocks in the market should receive a royal charter from the government of England. This must have been done to reduce the competition by The South Sea Company but it resulted in a negative effect for them as well. Overnight, the stocks crashed and people lost their money.

In order to understand the causes that lead to this, a committee was formed to investigate in the matter. It was found that the company had bribed the government officials, due to which a large number of members and officials were expelled from the Parliament in 1721.

Consequence of the bursting of the South Sea Bubble

The bursting of the South Sea Bubble brought negative consequences. Many people had invested in the smaller companies that had come up as a result of the ventures of The South Sea Company. Most of these people belonged to the weaker sections of the society and had lost the entire savings of their lives.

Consequently, the people of England responded in an aggressive manner. The events of suicides became very common and every day, hundreds of suicides started to be reported. Events of public lynching and abuse became common and women and immigrants were the victims in most of the cases.

Role of Sir Isaac Newton in the South Sea Bubble

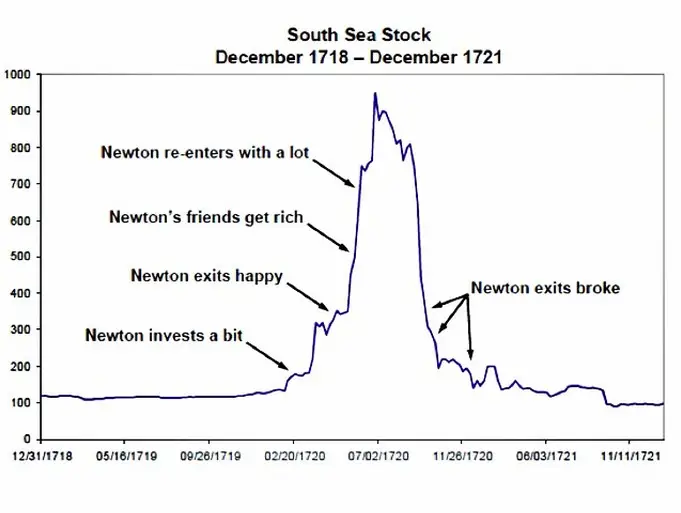

Sir Isaac Newton was a prominent member of the scientific community of England at the time when these events took place. He had invested some of his finances in the stock of The South Sea Company in the concluding months of 1719 and had earned some profit by early 1720. After this, he withdrew his investment from the company.

Within a few months, he saw people making large benefits from their investment with the company and invested a huge amount again, which was almost equal to his life savings. However, as the South Sea Bubble burst in 1720, he faced a major monetary loss. To the consequence of his event, he had allegedly said, “I can calculate the movement of the stars, but not the madness of men.

References of the South Sea Bubble in Literature

The South Sea Bubble became a very important event in the history of England. As a result of its effect on the social, financial and political structure of England, many writers wrote about the event in their works.

Alexander Pope and Charles Lamb were some of the renowned writers of that time and had invested their money into the stocks of the company. They managed to withdraw their investment in time and made huge profits from the same. They have drawn references from the event in many of their following works.

In Gulliver’s Travels, the even has been used by Swift in the form of a parody. The business failure of Lemuel Gulliver is reportedly the busting of the South Sea Bubble. His shipwreck is a reference to the false hopes of trade to the Spanish American lands. Thus, the event made up for the backdrop of the novel and contributed to its popularity in the country.